- February 3, 2026

- Posted by: Info

- Category: Business Insurance

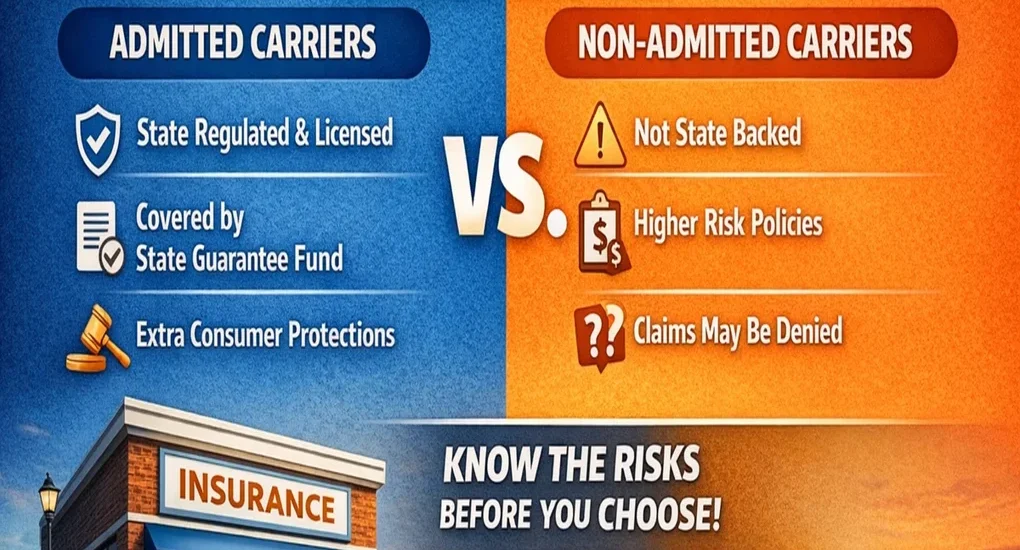

When shopping for insurance, most people focus on price. While saving money is important, choosing the right type of insurance carrier is just as critical, especially when it comes time to file a claim. One of the biggest differences in the insurance industry is between admitted carriers and non-admitted carriers. Understanding this difference can save your home and business. And financial future.

What’s an Admitted Carrier?

An admitted carrier is an insurance company that’s licensed and regulated by your state’s Department of Insurance. These companies must comply with strict financial, operational, and consumer protection regulations.

One of the biggest benefits of admitted carriers is access to the say guaranty fund. If an admitted insurer becomes insolvent, this fund helps protect policyholders and pay covered claims.

Admitted carriers also must:

Use say-approved policy forms

Follow speed regulations

Give strong consumer protections

Participate in complaint resolution programs

For most homeowners, drivers. And small businesses, admitted carriers give stability, reliability, and peace of mind.

What’s a Non-Admitted Carrier?

A non-admitted carrier isn’t licensed by the state. But it’s legally allowed to operate under “surplus lines” rules. These carriers are often used when standard companies won’t insure a certain risk.

Non-admitted carriers are commonly used for:

High-risk properties

Specialized businesses

Unique or hard-to-put coverage

Poor claims history

While non-admitted carriers can provide important solutions, they offer fewer consumer protections. They aren’t backed by the say guaranty fund. And their policy terms are often more restrictive.

This means claims may be harder to resolve. Coverage disputes can be more complex.

Why This Difference Matters

The biggest time you’ll feel the difference between admitted and non-admitted carriers is when you file a claim.

With an admitted carrier, you benefit from strong oversight and financial backing. With a non-admitted carrier, you rely entirely on that company’s financial strength and internal claims process.

Choosing the wrong carrier could lead to:

Delayed claim payments

Coverage denials

Limited legal protections

Unexpected out-of-pocket costs

That’s why working with an experienced independent agency matters. A professional agent helps you get when non-admitted coverage makes sense-and when it doesn’t.

👉 Not sure what type of carrier you have? Call Insuring Minnesota at 952-222-8073 for a free policy check today.

How Insuring Minnesota Helps

At Insuring Minnesota, we work with both admitted and non-admitted markets. Our target is never to “force” you into one option-it’s to find the best balance of protection, price, and long-term security.

We take the time to:

Look at multiple carriers

Explain coverage differences

Find potential gaps

Support for you during claims

You deserve insurance that works when you need it most, not just when you’re paying the bill.

👉 Insure correctly, to be sure. Call Insuring Minnesota at 952-222-8073 today and get expert guidance you can trust.